Big Exchange makes its mark on impact investing

The Big Exchange was created to spark a movement addressing the UK’s intricate and interrelated investment and financial services needs. Brittany Golob reports on the company’s approach to messaging, brand language and authentic communications

When the Big Issue was founded in 1991, it set out to tackle a big issue: the lack of sustainable income streams for at-risk and homeless individuals. Now, 30 years later, the company is one of the many organisations behind a financial services brand setting out to tackle some big issues of their own. The Big Exchange wants to generate a movement within the financial services sector that will improve transparency, inclusivity and sustainability.

It all started when a group of people met to craft a technology-enabled solution to the ‘poverty premium’ many people face when securing financial products, encourage the take-up of ethical investing and improve people’s investment capabilities, regardless of their wealth.

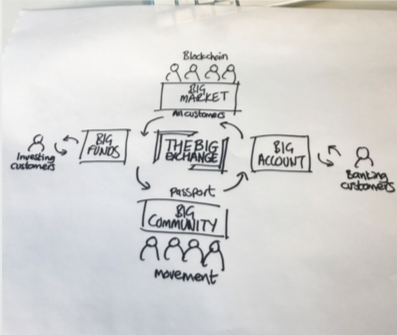

Ian Henderson, CEO of creative communications consultancy AML, was charged with combining those goals into a single overarching mission, brand and communications strategy. To do so, the Big Exchange has launched with a focus on impact investing, to begin with, and will be rolling out products including a free money manager tool, access to loans, pensions and the like in due course.

It’s a Herculean task, but the Big Exchange is relying on its clarity of purpose to launch the movement. “Just the impact investing platform is a complicated undertaking in itself,” Henderson says. “If you think of Hargreaves Lansdown, Nutmeg, Vanguard, these are big firms and they’ve built investing platforms, by investing a huge amount of money. We didn’t have money. We tried to do something as good as that with little money, but with a very clear focus on impact investing, only.” This helped the Big Exchange engage in relationships with investment sector partners.

Aberdeen Standard Investments, Columbia Threadneedle Investment, Alquity, Pictet Asset Management all bought into the mission from the get-go. Now, the roster of funds has expanded to 13, with more to be added. The support of these ethical investment funds was important in providing seed money for the Big Exchange, but also in terms of actually creating a viable investment platform. A tech firm called FNZ joined forces as well. Then, it was up to AML to craft a visual identity, tone of voice and communications strategy for the new venture.

“It creates an emotional connection to investments that quite often isn’t there. That was something that we were really keen to draw out in the brand. How can we create that emotional connection with something that, in the UK, people don’t really talk about that much?”

.

AML has also enabled the Big Exchange’s partner companies and funds to communicate more clearly through branded toolkits and a straightforward use of language across the platform. The Big Exchange's MD Jill Jackson says the audience for the platform may be diverse, but the messaging and visual identity will remain consistent across all channels and areas of communications. That will not only help the Big Exchange communicate its complex model simply, but may facilitate the democratisation of financial services that the company is setting out to achieve. “For us, it always comes back to authenticity and truthfulness. People want you to be honest with them. That’s the core, critical thing,” Jackson adds. “We take that seriously in all aspects of our business.” To that end, the Big Exchange is seeking to diversify its board and workforce, to reflect the society it serves.

AML has ensured consistency across all communications, while also delivering a memorable and effective impact well beyond launch. “The risk is that you go off like a box of fireworks and you end up going off with lots of messages,” Henderson says. “We have to keep it disciplined.”

The name ‘the Big Exchange’ is derived in part from the connection with the Big Issue, and in part because the goal is to eventually run the platform as an exchange, where people invest in impact funds, which will provide the capital to offer financial products to all who need them. “It is an exchange where people can help each other,” Henderson says. “People can invest in companies that do social good. People can get free banking. They can take from that what they want and give to it what they can.”

The model taps into several trends defining sustainability and money management. One issue Jackson hopes to address through the platform is investment literacy and confidence among a younger demographic. “Traditionally, in financial services, [branding] is done with a really narrow target market in mind. Over time, that’s a self-fulfilling prophecy. You end up with only people like that investing. That’s why we’re in the situation we’re in with people not investing or people not saving enough. Financial services has just spoken to a thin slice of the UK public.” Compounding that, Millennials are due to live longer than previous generations, requiring further funds for retirement.

But for many, the investment sector is not speaking their language. One of the ways the Big Exchange is addressing that is by working closely with its partner funds to craft human, easily understandable communications about investing and the value inherent in money management. As most funds largely speak to professional or educated investors, this has forced a change in the way they communicate as they are now speaking directly to customers.

The second trend Jackson discussed was the move toward sustainable lifestyles. If a person recycles, she says, as an example, they might want to extend that mindset into other aspects of their life. That’s the role impact investing can play. But, it can also yield another crucial benefit. “It creates an emotional connection to investments that quite often isn’t there. That was something that we were really keen to draw out in the brand. How can we create that emotional connection with something that, in the UK, people don’t really talk about that much?” she asks.

Another big challenge is the lack of trust in financial institutions. Edelman’s Trust Barometer consistently ranks the sector at the bottom of its ranking. Though, financial services has recovered slightly from its 10-year trust nadir in 2012. “Trust is absolute gold dust in the sector because you are asking people to give you their life savings. It’s quite a big ask, if you think about it,” Henderson says. But, the Big Exchange is addressing that through its collaboration with the Big Issue and the powerful, charitable foundations behind that organisation. The Big Issue's positioning of ‘a hand up, not a hand out,’ brings with it a lot of clout. Coupled with that are independent evaluators’ marks of approval and the ethical investing commitment the Big Exchange is centred around.

“We’ve got a very strong graphic identity. That’s very important if you haven’t got much money. The branding is designed to cut through, to be distinctive, to be impactful.”

To address the complex needs of several audiences and the intricacies of the investment landscape, the Big Exchange’s branding had to be simple and focused. The colour palette draws from the Big Issue’s red, black and white, while the typeface and logo design is similar to its namesake’s. But the logo is bracketed by corner L shapes, rather than enclosed. This is a deliberate design choice indicating the organisation’s purpose of bringing people together. It’s a device that has carried through early imagery, with a split screen featured along the diagonal. “We’ve got a very strong graphic identity,” Henderson says. “That’s very important if you haven’t got much money. The branding is designed to cut through, to be distinctive, to be impactful." The communications strategy has focused on print ads and social media but will expand to include influencer marketing and an aggressive, guerrilla approach to media engagement. “It’s not a conventional business, it’s a movement,” Henderson adds. “It’s about democratisation of access.”

Jackson summarises the positioning clearly; the Big Exchange “creates an immediate societal impact while you invest and make money for yourselves.” Though, there’s still a ways to go, with education and information of the target audience a key focus in the post-launch stage. Collaboration will facilitate future expansion as new, accessible financial products are rolled out.

“There is a trend towards using money to do good. There is a trend towards trusting the technology to do that. That’s what we’re part of,” Henderson says. That’s what the Big Exchange’s branding will continue to reflect too, as the organisation develops and its portfolio expands, uniting the big issues that face financial services and British society today.