Spotlight on BNY Mellon Investment Management

Focusing on brand strategy, architecture and consolidation, BNY Mellon Investment Management delivered a rebrand that would clarify its relationships with its internal audience and with its clients. Brittany Golob reports

When global chief marketing officer at BNY Investment Management Anne-Marie McConnon first joined the group, she wanted to do things differently. An experienced investment industry marketing director, McConnon wanted to shape the department and the brand into a groundbreaking, paradigm shifting group that could set the tone for a new era of investment management.

Part of that journey was the implementation of a professional, journalism-founded newsroom that was designed not just to regurgitate dull copy about investments, but to provide critical insight into the business and its context. That helped unite the customer perception of BNY Mellon Investment Management – which research showed was of an innovative, modern company – with its own internal workings.

But, the biggest expression of that objective to date has been the bank’s rebrand, which launched in June 2019. With a global rebrand of the BNY Mellon group, and its three sub-brands Investment Management, Wealth Management and Investment Services, the bank would consolidate its brand and reconfigure its brand architecture to better serve its many audiences.

“The work that I’ve been doing on the brand in the past 18 months has been very much about aligning business strategy and brand,” McConnon says. “It should tell the story of where the business is going. If you don’t start with that, then it’s going to be pretty difficult to execute.” BNY Mellon Investment Management put strategy first. The rebrand, of course, included an updated visual identity. The bank worked with London-based professional and financial services expert, Uffindell Group, on the rebrand.

The visual identity was stripped back to the point where the core message of putting the investor first is the primary means of communication. “You don’t need to say a lot around that,” chairman and founder of the Uffindell Group, Erika Uffindell, says. The point was to clarify the relationship between the investors and the bank itself, as well as between the investment boutiques that sit underneath the Investment Management (IM) umbrella and the central BNY Mellon brand.

Doing so required the eight boutiques within the IM brand to be tidied up. The boutiques themselves retain their branding, except US brand Dreyfus. Some aspects of the Dreyfus brand were retained, as a nod to its heritage and brand recognition across the US. But one of the key changes was the renaming of the BNY Mellon Cash Investment Strategies division of Dreyfus, to Dreyfus Cash Investment Strategies. The move was made to better reflect the relationships between the boutiques and institutional investors while promoting the global prominence of the BNY Mellon IM brand itself. The remaining boutiques of Alcentra, ARX, Insight Investment, Mellon, Newton, Siguler & Guff and Walter Scott retain their individual branding.

The overarching BNY Mellon IM brand has been updated to align with the BNY Mellon group brand update. The arrowhead mark still in use today, was crafted in 2007 by Lippincott following the merger between the Bank of New York and Mellon Bank. This replaced a multicoloured square shape logo used by the Bank of New York and a Siegel+Gale-desgined simple, pine green wordmark for Mellon Bank.

But the arrowhead’s use as a key asset was only redefined in the recent rebranding process. “Some of the other messages that came out of the research around the investment firm of the future, around agility. And so that arrow has this wonderful way of pinpointing what’s important,” Uffindell says. The arrow helps communicate that the considerations of the investor are critical to the bank as well. Uffindell calls it a brave move, too, to simply rely on a single image and line of copy.

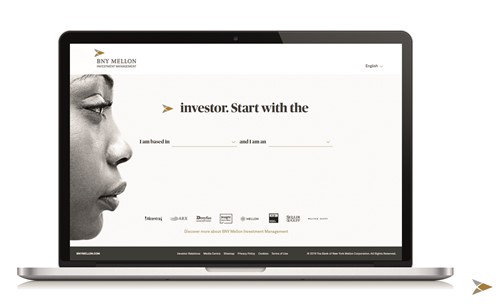

But the contemporary approach allows for the communication of powerful messages and the implementation of design solutions to communicate more effectively. A good example is the homepage of the BNY Mellon IM website, which simply shows the arrowhead, with the copy ‘Investor. Start with the. I am based in (blank) and I am an (blank)’ allowing for investors to quickly input their details into the blanks and be served relevant information immediately. “Everyone is overloaded with communications and those very powerful, simple messages; those very powerful ways of expressing that in design speak volumes about how that brand sees itself and how it sees its role in communicating and partnering with its clients,” Uffindell adds.

But the primary purpose of the rebrand was to better express the group’s architecture, align the boutiques more closely with the parent company and refocus the brand to better communicate the business’ strategy.

To tackle this, the first step was research. Uffindell and BNY Mellon IM interviewed employees and clients around the world. McConnon said one of the key findings was that the volatility of the financial market meant investors “really wanted a manager that they could trust, but also that could provide new and creative ways for providing investment return.” They questioned the ability of a monolithic brand to achieve such agility. “How can you really be an expert and focus on the investment business while understanding clients’ needs?” McConnon asks. The solution inherent in the BNY Mellon IM structure helps solve this conundrum. The group is comprised of both the strength and heritage of the Alexander Hamilton-founded BNY Mellon brand behind it, and the versatility and client-centricity of its investment boutiques. This helped clarify the strategy of putting the investor first. However, the BNY Mellon IM brand will be used more prominently now. It will lead with that brand, while offering the multi-boutique model as its commitment to putting the investor first. This will not only help with clarity of brand architecture, but with brand consistency.

The entire Investment Management business will now have a consistent tone of voice, imagery and brand principles allowing for clearer communications and a closer integration between the boutiques and the parent brand.

In practice, that has meant a clarification of the naming system used worldwide. The company had seven different naming systems for its funds and products – a result of the boutiques using their own nomenclature – which has now been transformed into a single, consistent strategy. “It’s quite game-changing and transformative,” McConnon says. She ensured that the change would not remove the unique culture within each fund, but support the funds with the BNY Mellon IM brand, allowing them to attract the best talent, communicate most effectively and promote heritage and investment power.

“This speaks to what the clients expected and believed that BNY Mellon can deliver. To me, it’s an alignment of their aspiration and the capabilities, abilities and ambition of BNY Mellon Investment Management”

Consistency was also built across the BNY Mellon group, with BNY Mellon IM’s tone of voice coming into alignment with that of the parent brand. Now, the bank is able to talk in a more human way, something McConnon says isn’t done very well in the asset management space.

By working with clients and internal stakeholders throughout the process – and nominating 50 brand ambassadors to help with the rollout – Uffindell was able to craft a strategy that would work for the many audiences within the business. Uffindell tested a few working hypotheses to determine the direction the brand strategy should take. She put these forward with internal stakeholders at BNY Mellon IM and within each boutique. “An important part of this process was to ensure that they were not just fully engaged, but that they were also very much a part of the process of building the ultimate brand platform and brand strategy,” Uffindell says.

The resulting brand tenets were ‘being relentlessly investor driven,’ with ‘world-class capability,’ and ‘world-class specialists,’ all underpinned by the financial stewardship offered by the BNY Mellon brand.

The executive team within BNY Mellon Investment management was supportive of this approach. It sponsored the project itself, with CEO Mitchell Harris offering support throughout the process. He says, “This is another step in our strategy to illustrate how we offer investors the best of both worlds: providing clients with access to the investment capabilities and solutions from our world-class investment managers, combined with the global scale and financial stewardship of BNY Mellon. These changes form part of a significant global brand initiative for our investment management business that will help further align our brand to our business strategy.” He called it a significant step toward the fund’s growth.

McConnon agrees, saying that the brand strategy and consolidation is a step toward positioning BNY Mellon Investment Management as a challenger bank. With the strategy piece put into place, the next steps will be to examine client experience, organising the business around the investor, and promoting internal change across the business to support this.

She hopes that the changes will not only improve the perceptions of BNY Mellon Investment Management and more closely align them with the experience of investors, but encourage a more diverse audience to invest. “Women are massively underinvested,” she says. Communications and targeting need to be more diverse, she says. “You’ll see from us much more diverse imagery and a more premium, luxury brand status.”

And in the months since the rebrand launch, the results have proven it worth the effort. BNY Mellon Investment Management saw a fourfold increase in its weekly traffic immediately after its launch, with new sources of traffic landing on its site. This resulted in an immediate uplift in brand awareness following the launch campaign. The bank has also recorded an increase in the ‘future intention to do business with us’ factor.

From the internal perspective, Uffindell sites the brand ambassadors and initial research stages as key to paving the way for the brand rollout. There has been a positive shift among employees in their understanding of the vision of the bank as well as their understanding of the brand and the roles they can play within it. Additionally, a clarity and understanding of their own roles and how they can help to build the brand prove to be important indicators of success for the rebrand.

“This speaks to what the clients expected and believed that BNY Mellon can deliver. To me, it’s an alignment of their aspiration and the capabilities, abilities and ambition of BNY Mellon Investment Management,” Uffindell says.

Inspiring change from within has been a the main objective of McConnon’s marketing strategy since she joined the bank. Now, with a rebrand in place and an updated brand strategy, it is finally coming to fruition across all aspects of BNY Mellon Investment Management’s operations.

Peer review

Sholto Lindsay-Smith, director, Industry

BNY Mellon Investment Management has $1.8tn assets under management. So the decision to bring its 34 funds under the BNY Mellon name is brave. Does it make sense? As part of a global strategy to increase the firm’s brand presence in the retail market, yes.

But there is a snag in the brand architecture: BNY Mellon’s eight boutique brands, including Newton and Insight, will continue as operating brands, responsible for managing the funds. This means you have BNY Mellon, offering the BNY Mellon Asian Equity Fund, managed by Newton. This ‘best of both worlds approach’ feels like a bit of a fudge. It is a bit like Tesco offering own brand Tesco beans, manufactured by Heinz. The premium product brand has become subservient to the retailer brand.

If the strategy is to build the BNY Mellon brand, arguably it could achieve this faster and avoid dilution and possible confusion, by ditching these subsidiary brands. That would be very brave.

The execution though is clean. The strong use of black and white photography is powerful and intriguing and works brilliantly with the brand colour palette.

The use of the logo in the imagery – making the spark in the spark plug – feels like an advertising treatment rather than an enduring brand platform. I can’t help but hear my mentor and one of the pioneers of identity design say, “don’t mess with the logo.” But rules are there to be broken.

To be fair, it’s a complex challenge loaded with risk. It is a brave play that will pay dividends. Will the boutique brands survive much longer? I not so sure.